US REITs Aren't Expensive — They're Uneven

Crowding, operating risk and the sectors investors forgot

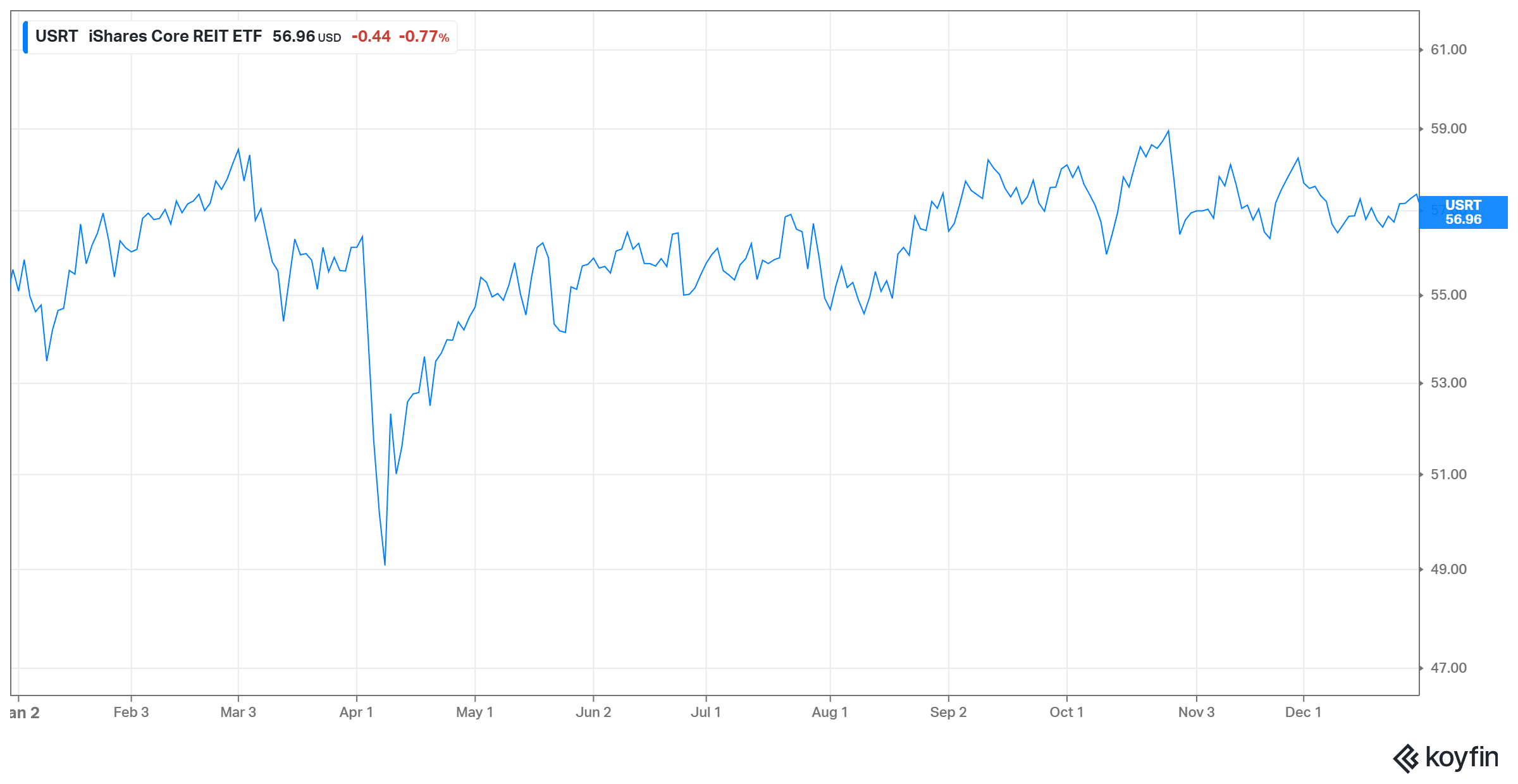

Despite all the talk about Data Centres and interest rates, U.S. REITs went nowhere in 2025. Depending on the index you use, total returns are up ~ +2.1% , a forgettable outcome. But there's a lot under this bonnet. REIT performance looks dull because capital has crowded into a narrow set of perceived “safe” winners , leaving several ‘boring’ sectors that nonetheless generate steady cash flow. These subsectors trade at what I think are compelling valuations. I will unpack a couple of points in this post.

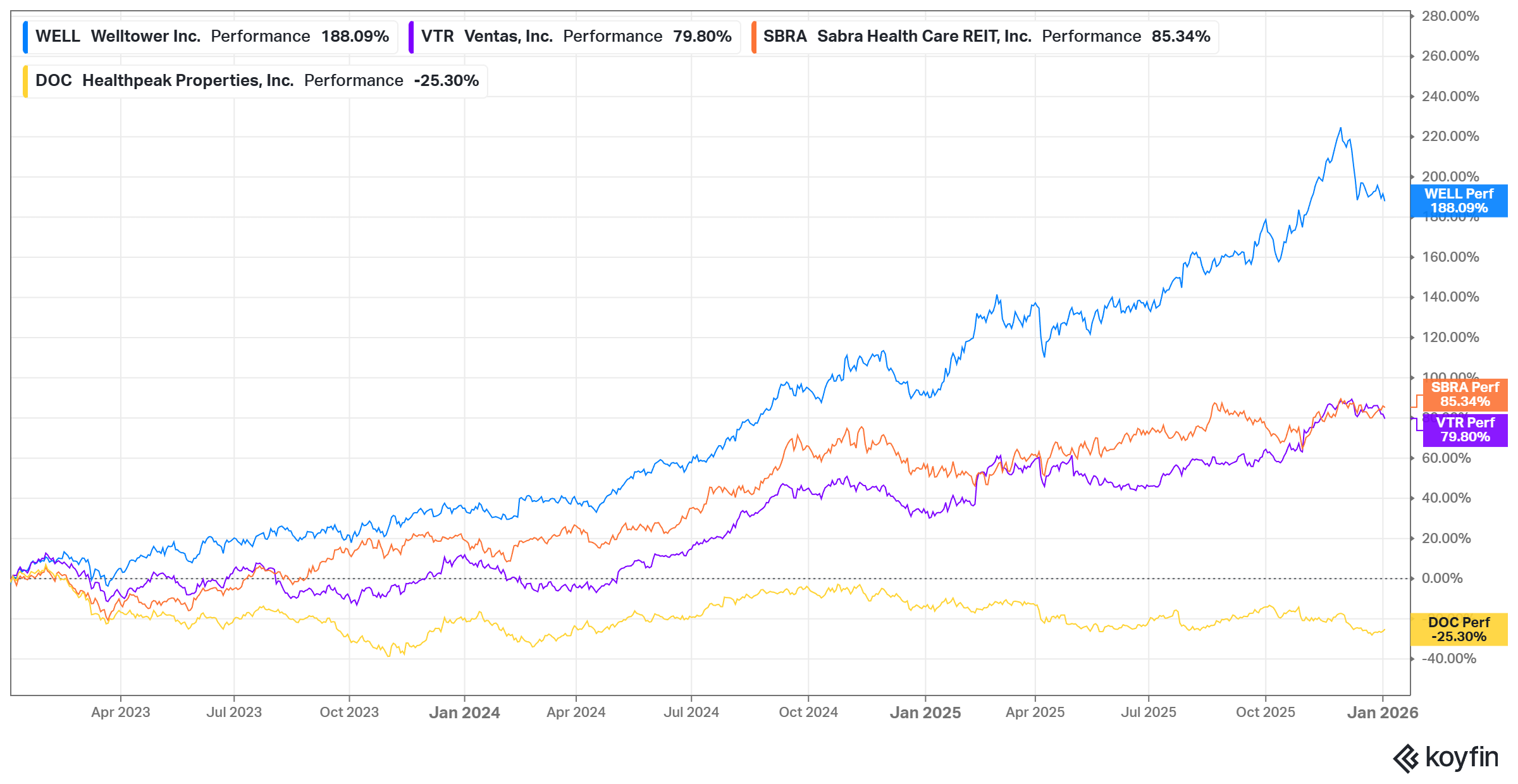

For the REIT nerds, 2025 was interesting. Lack of M&A? Yeah, maybe. But longtime listeners have seen Simon (SPG) dominate the REIT index, followed by Prologis (PLD) as the malls died and everyone thought we would be buying everything online. This year saw the top crown move from PLD to healthcare REIT Welltower (WELL).

The Welltower Problem: When “Defensive” Stops Being Defensive

The largest REIT — and by far the biggest contributor to REIT index returns this year — is Welltower . Its performance explains much of the sector's modest gains.

But Welltower today is not the same company it was a decade ago.

When people think of healthcare, they think of ‘triple-net’ leases, where nearly all expenses are borne by the tenant, really long lease terms, fixed escalators, etc. The long terms and fixed bumps fool some investors into thinking they are ‘bond-like’ investments. The problem with healthcare, besides dire labour shortages, is that margins are low. A good healthcare service business runs on margins of ~15% after rent. A healthcare landlord offers a long lease to an operator, but with high rents and low margins, operators can go awry very quickly. Landlords are the second to know, with landlord investors (that is, REIT investors), unlucky third in the loop.

While WELL was historically viewed as defensive, it has steadily moved up the risk curve , particularly through its exposure to SHO (Senior Housing Operating) assets. That is, rather than simply act as landlord to a healthcare operator, it cuts a deal with an operator, where the REIT is exposed to all the operating leverage and risk. Because they own the property, rent isn't being paid, and margins appear much higher (~30%). There are no credit problems that always appear in a triple-net portfolio. While this seems less risky, the real estate is still exposed to a low-margin business. Particularly when compared to other property sectors (residential, self-storage margins are around 70%). Welltower is largely a healthcare operating business, with earnings tied to occupancy, labour costs, reimbursement dynamics, and — critically — operator quality.

The demographic “silver wave” is real, but it is also well understood, heavily capitalised and increasingly mature . As that wave plateaus, operational stresses can surface quickly. When operators struggle, the information asymmetry is large — and public market investors are often the last to find out. Due to the low margins in the space, a decline in occupancy or increases in labour costs can cause earnings estimates to tumble.

Welltower may still be a quality company, but at current multiples it looks less like a defensive REIT and more like a priced-for-perfection operating business.

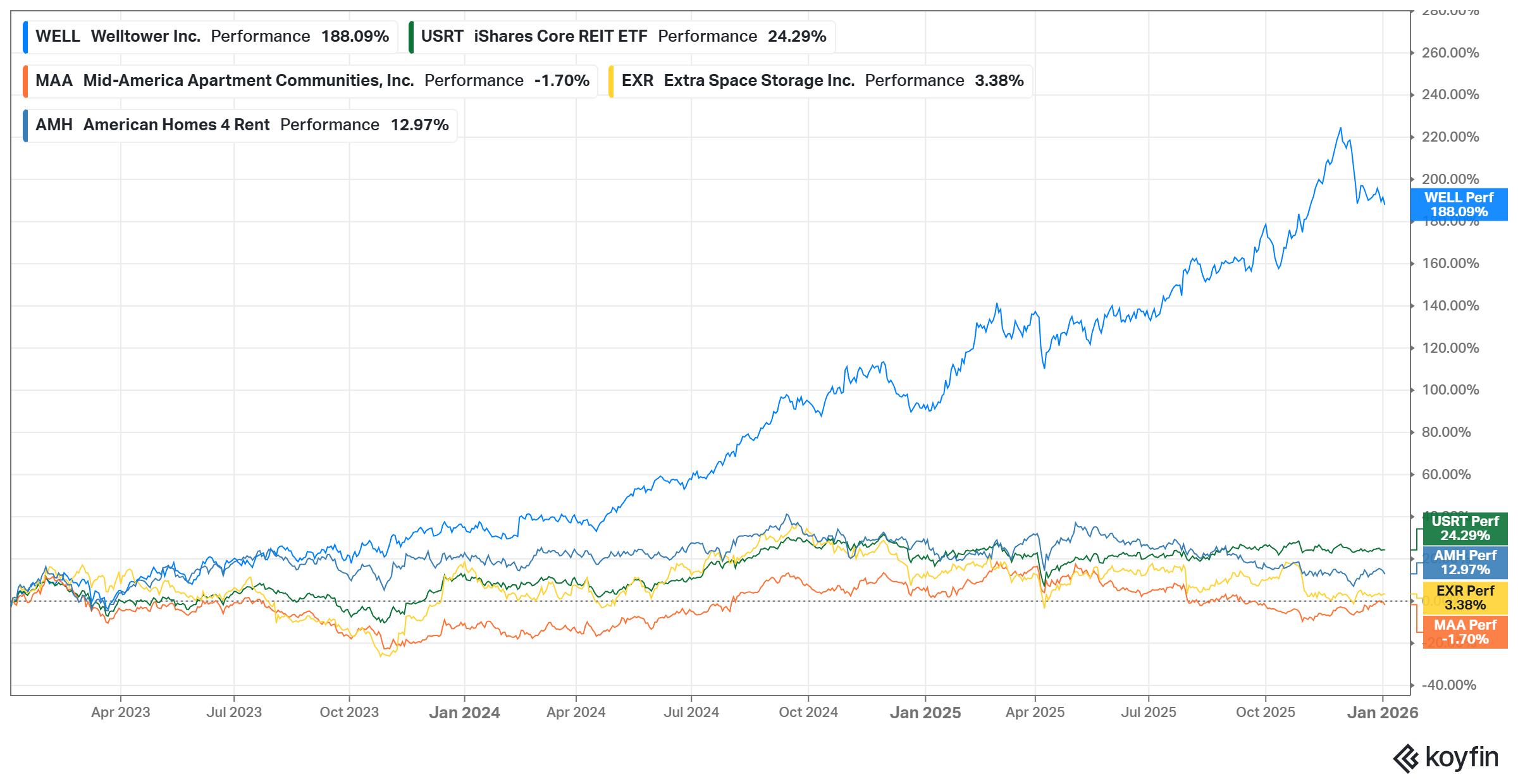

Where the Market Hasn't Gone: Residential and Self-Storage

While capital chased healthcare and data-adjacent narratives, residential and self-storage REITs have quietly underperformed .

In my view, this is where the value is.

Residential REITs: Fundamentals First

There has been renewed debate about whether a reduction in the enhanced Supplementary Leverage Ratio (eSLR) will spur bank lending and, by extension, real estate activity. I remain sceptical.

As I understand it, the eSLR is not the binding constraint for most banks. Basel III risk-based capital remains the dominant limiter on lending capacity. Lowering leverage requirements does not meaningfully change banks' willingness to take credit risk. Conks writes a solid note explaining this.

Alan Longbon takes a different view but given where pricing is today: residential REITs don't need a credit boom to work, but it might be a catalyst.

Fundamentals alone are supportive:

Household formation has increased, with household finances in good shape

Supply is constrained in many metros

Migration toward the Sunbelt continues

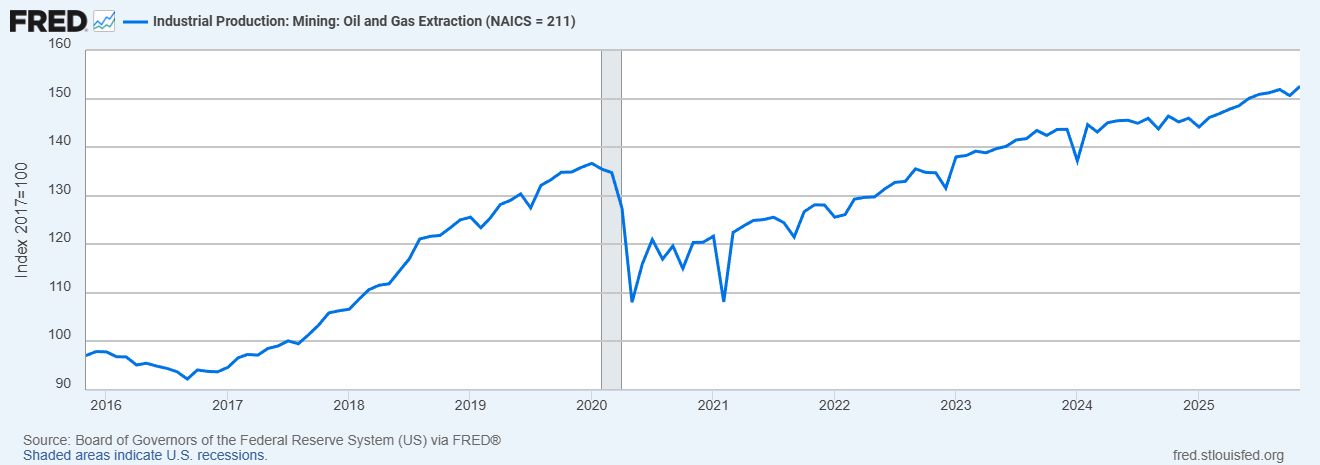

Data-center expansion and energy investment driving regional employment growth

If U.S. energy production continues to accelerate — downstream effects on housing demand in energy-linked and infrastructure-heavy regions should not be underestimated.

Residential REIT valuations are not stretched by any conventional metric. On my estimates, the residential sector (that is, multifamily and single-family housing) trades on an implied EBITDA yield of 6%. Even modest rent growth or stabilisation in underlying dwelling prices would meaningfully support NAVs and equity prices.

Self-Storage: The Overlooked Companion Trade

Self-storage REITs are often dismissed as late-cycle or “COVID pull-forward” trades. And it's true — the sector has been in a cyclical drawdown for some time.

But that's exactly why it's interesting.

Self-storage demand is structurally linked to residential mobility:

Household formation

Downsizing and upsizing

Geographic relocation

Natural disaster recovery

Small business inventory needs

As residential activity picks up, self-storage tends to follow — often with a lag.

Today, the sector reflects:

Cyclical pessimism

Slowing same-store NOI growth

Conservative forward assumptions

What it does not reflect is any structural impairment to the business model. By my estimates, the sector trades at an EBITDA yield of ~6.3%. Quite a reasonable valuation, in my view.

Conclusion

The REIT market is not expensive — it's uneven.

Crowded trades in healthcare and perceived “defensives” now embed operational and valuation risk

Residential REITs offer clean exposure to rent growth and asset appreciation without relying on regulatory tailwinds

Self-storage provides a complementary, cyclical recovery trade tied to the same housing dynamics

In my view, this leaves passive/index investing in REITs a recipe for mediocrity. There needs to be some discernment on real estate exposures.